A new smart microgrid community in Pickering, Ont. demonstrates how developers, communities and hydro companies can work together to create more energy-efficient housing developments while helping homeowners reduce their electricity bills.

What is the future of home-buying in the age of a climate crisis? Given the increasing frequency of power outages, developers will be looking to the new Altona Towns, the first microgrid community, as its blueprint.

If you’ve ever wanted to live off the grid — a newly built Pickering development may be just the place for you.

A micro-grid community in Pickering – Canada’s first – features a localized electrical grid that saves homeowners money by augmenting their power supply and also providing backup power if there’s an outage.

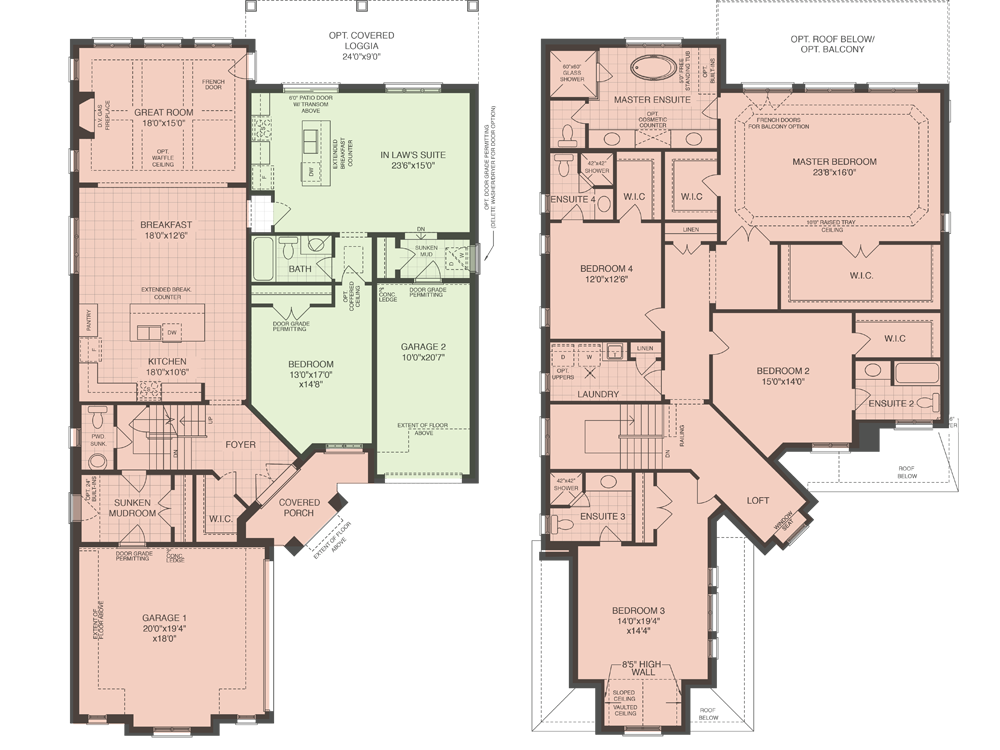

One form of multi-generational housing gaining popularity is the custom-built ground-level home within a home…

Many areas across the globe are looking at providing non-traditional power to residential neighborhoods, part of a push to make a community’s electricity supply more reliable and resilient…

The Smart Microgrid Community is the first preplanned nest microgrid project in Canada to integrate a full-scale, operational smart residential energy system. The community includes ….

Within a few days of moving into his new townhouse, part of the recently built Altona Towns development in Pickering, Conor Soye was ….

A growing trend in home use is rising from a tradition that was once just the way we lived: multi-generational housing.

When Mark Rittinger began dating his wife, Ana, she was clear: at some point her parents would be living with them.

“As long as I was cool with that, the relationship could continue. But if I wasn’t cool, she wanted me to know ….

A Toronto builder is making homes specifically designed for multiple generations, each in their own space, all under one roof

A new townhouse project in Pickering is harnessing the power of the sun and the power of the next generation at builder Marshall Homes ….